Personal property tax in Jackson County, MO, is a critical aspect of local taxation that directly impacts residents and business owners alike. Whether you're a new resident or a seasoned taxpayer, understanding how this system works and how to obtain your personal property tax receipt is essential. This article will provide you with comprehensive insights into the process, benefits, and requirements for managing your personal property tax effectively.

As part of the broader tax structure in Missouri, personal property tax plays a significant role in funding public services and infrastructure. By staying informed about your obligations and rights, you can ensure compliance and avoid potential penalties. This guide will walk you through everything you need to know, from calculating your tax to retrieving your receipt.

Our aim is to equip you with actionable knowledge and resources to simplify your tax experience. Whether you're looking for detailed explanations or quick tips, this article has you covered. Let’s dive into the specifics of personal property tax in Jackson County, MO, and how you can efficiently handle your receipts.

Read also:Lil Scrappy Mother The Untold Story Of The King Of Trap Music

Table of Contents

- Introduction to Personal Property Tax

- What is Personal Property Tax?

- Importance of Personal Property Tax Receipt

- How to Obtain Your Personal Property Tax Receipt

- The Personal Property Tax Payment Process

- Common Questions About Personal Property Tax

- Understanding Tax Appeals

- Tips to Avoid Penalties

- Useful Resources and References

- Conclusion and Call to Action

Introduction to Personal Property Tax

Defining Personal Property Tax in Jackson County

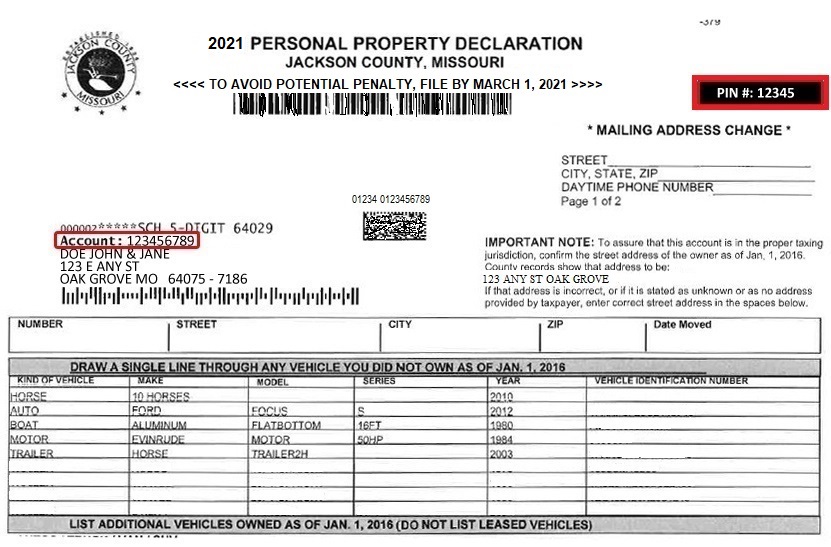

Personal property tax in Jackson County, MO, refers to the tax levied on movable assets owned by individuals or businesses. These assets can include vehicles, boats, and other tangible items. The revenue generated from this tax is crucial for supporting local government services such as schools, public safety, and infrastructure development.

Understanding the nuances of personal property tax is vital for both individuals and businesses to ensure they are meeting their financial obligations. By familiarizing yourself with the tax structure and deadlines, you can avoid unnecessary complications and maintain compliance.

What is Personal Property Tax?

Key Features of Personal Property Tax

Personal property tax is a form of ad valorem tax, which means it is based on the assessed value of the property. In Jackson County, MO, this tax is calculated annually and is due by a specific deadline. The assessed value of your personal property is determined by the county assessor, who evaluates the current market value of your assets.

- Tangible personal property includes items like vehicles, equipment, and furniture.

- Intangible personal property, such as stocks and bonds, is generally exempt from this tax.

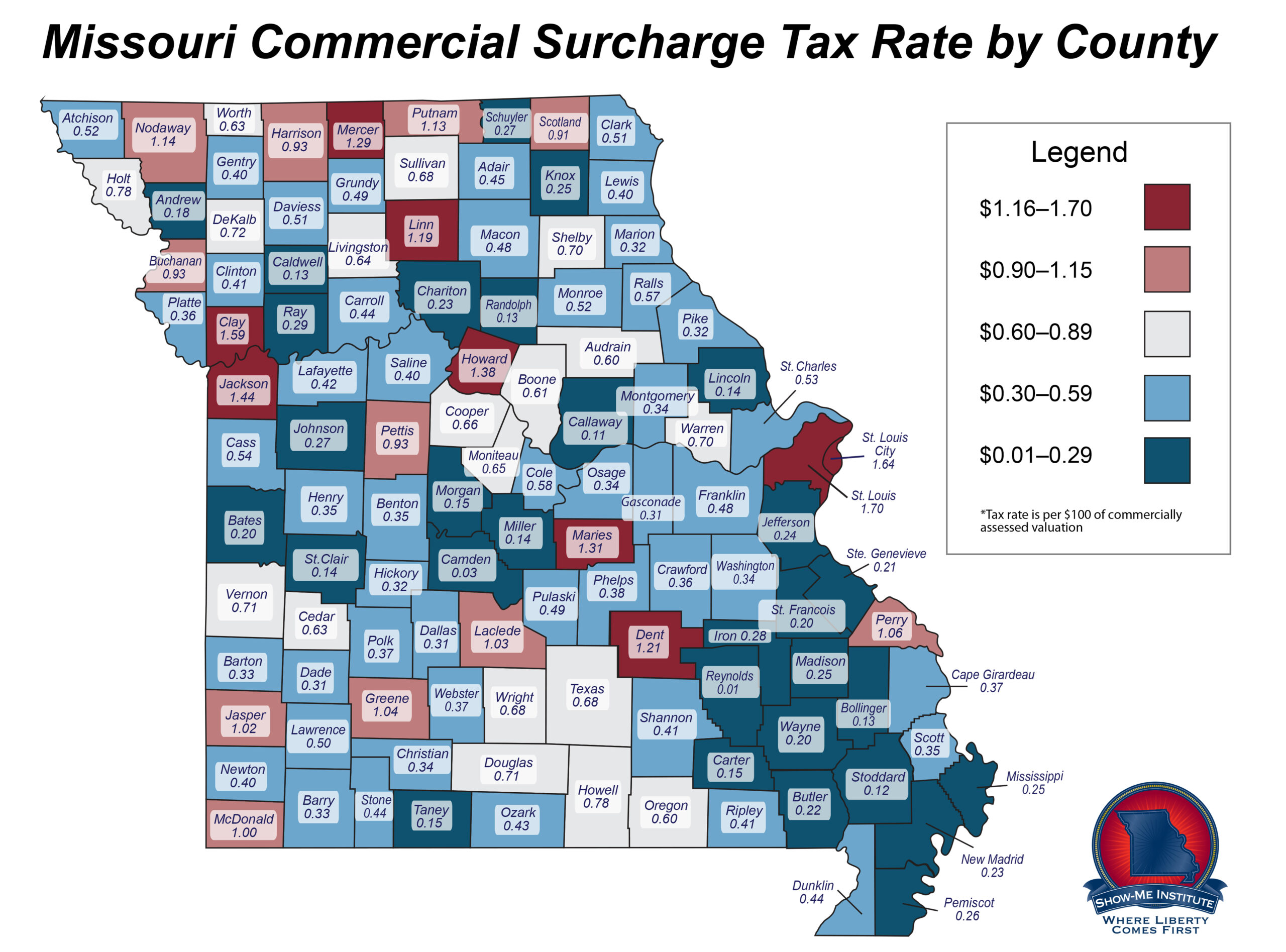

- The tax rate varies depending on the jurisdiction and the type of property being taxed.

Importance of Personal Property Tax Receipt

Why You Need a Tax Receipt

Obtaining a personal property tax receipt is essential for several reasons. First, it serves as proof of payment, which can be crucial when dealing with legal or financial matters. Additionally, having a receipt ensures that you can track your payments and verify that your account is up to date.

A tax receipt also provides peace of mind, confirming that your obligations have been met. In some cases, it may be required for vehicle registration or other official transactions. Therefore, keeping your receipts organized and accessible is a smart practice.

How to Obtain Your Personal Property Tax Receipt

Steps to Retrieve Your Tax Receipt

There are several methods to obtain your personal property tax receipt in Jackson County, MO. You can request a copy online through the county's official website or visit the tax collector's office in person. Here’s a step-by-step guide:

Read also:Sly Stallone The Iconic Biography Of A Hollywood Legend

- Visit the Jackson County Collector of Revenue website.

- Log in to your account or enter your tax ID number and other required details.

- Locate the payment history section and download or print your receipt.

Alternatively, you can contact the tax office directly to request a copy of your receipt. Be sure to have your identification and payment information ready to expedite the process.

The Personal Property Tax Payment Process

Understanding the Payment Options

When it comes to paying your personal property tax, Jackson County offers multiple convenient options. You can pay online using a credit card or electronic check, mail a check, or pay in person at the tax office. Each method has its own advantages, so choose the one that best suits your needs.

It's important to note that late payments may incur penalties and interest charges. Therefore, it's advisable to plan ahead and ensure your payment is submitted on time. By setting reminders or scheduling automatic payments, you can avoid any potential issues.

Common Questions About Personal Property Tax

Answers to Frequently Asked Questions

Here are some common questions taxpayers often have regarding personal property tax in Jackson County, MO:

- Q: What happens if I miss the payment deadline? A: You may be subject to penalties and interest charges.

- Q: Can I dispute my assessed value? A: Yes, you can file an appeal with the county assessor.

- Q: Are there any exemptions available? A: Certain types of property, such as agricultural equipment, may qualify for exemptions.

Understanding Tax Appeals

How to File a Tax Appeal

If you believe your personal property has been assessed at an unfair value, you have the right to file a tax appeal. The process involves submitting a formal request to the county assessor’s office, providing evidence to support your claim. It's crucial to follow the proper procedures and deadlines to ensure your appeal is considered.

Consulting with a tax professional or attorney can be beneficial if you're unsure about the appeal process. They can provide guidance and help you navigate the complexities of tax law in Jackson County.

Tips to Avoid Penalties

Best Practices for Staying Compliant

Staying compliant with personal property tax requirements is key to avoiding penalties. Here are some tips to help you stay on track:

- Set up automatic reminders for payment deadlines.

- Keep detailed records of your assets and their assessed values.

- Regularly review your tax statements for accuracy.

By taking these proactive steps, you can ensure that your personal property tax obligations are met without any hiccups.

Useful Resources and References

Where to Find More Information

For additional information on personal property tax in Jackson County, MO, consider the following resources:

- Jackson County Collector of Revenue website

- Missouri Department of Revenue

- Local tax professionals and legal experts

These resources provide valuable insights and can help you stay informed about any changes or updates to tax laws and regulations.

Conclusion and Call to Action

In conclusion, understanding and managing your personal property tax in Jackson County, MO, is a crucial responsibility. By obtaining your tax receipt, staying informed about the payment process, and utilizing available resources, you can ensure compliance and avoid unnecessary penalties.

We encourage you to take action by reviewing your tax obligations, setting up reminders, and seeking professional advice if needed. Don’t forget to share this article with others who may find it helpful and explore more content on our website for further guidance.